Renovating your kitchen, bathrooms, and closets are the top improvements that can increase the resale value of your home!

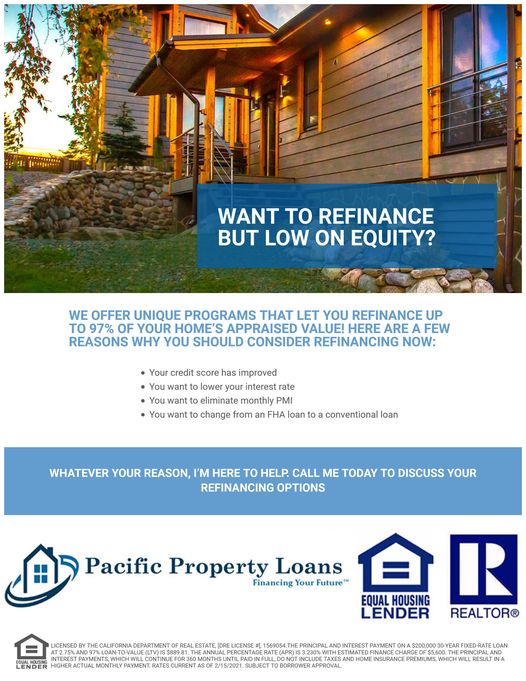

Refinancing your home loan is a cost-effective way of doing it.

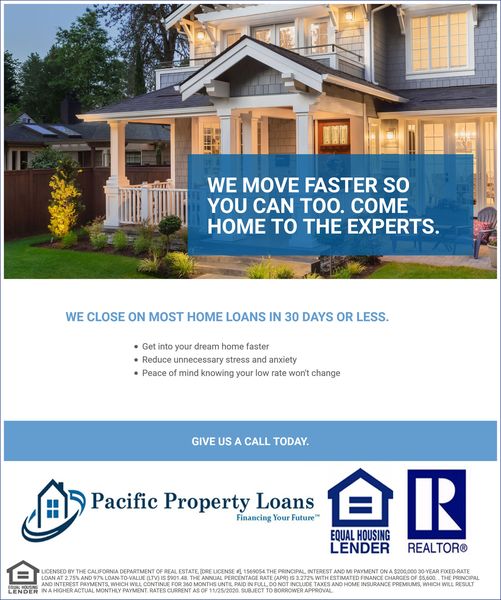

Please click here to contact a Pacific Property Loans’ Loan Officer to learn more.